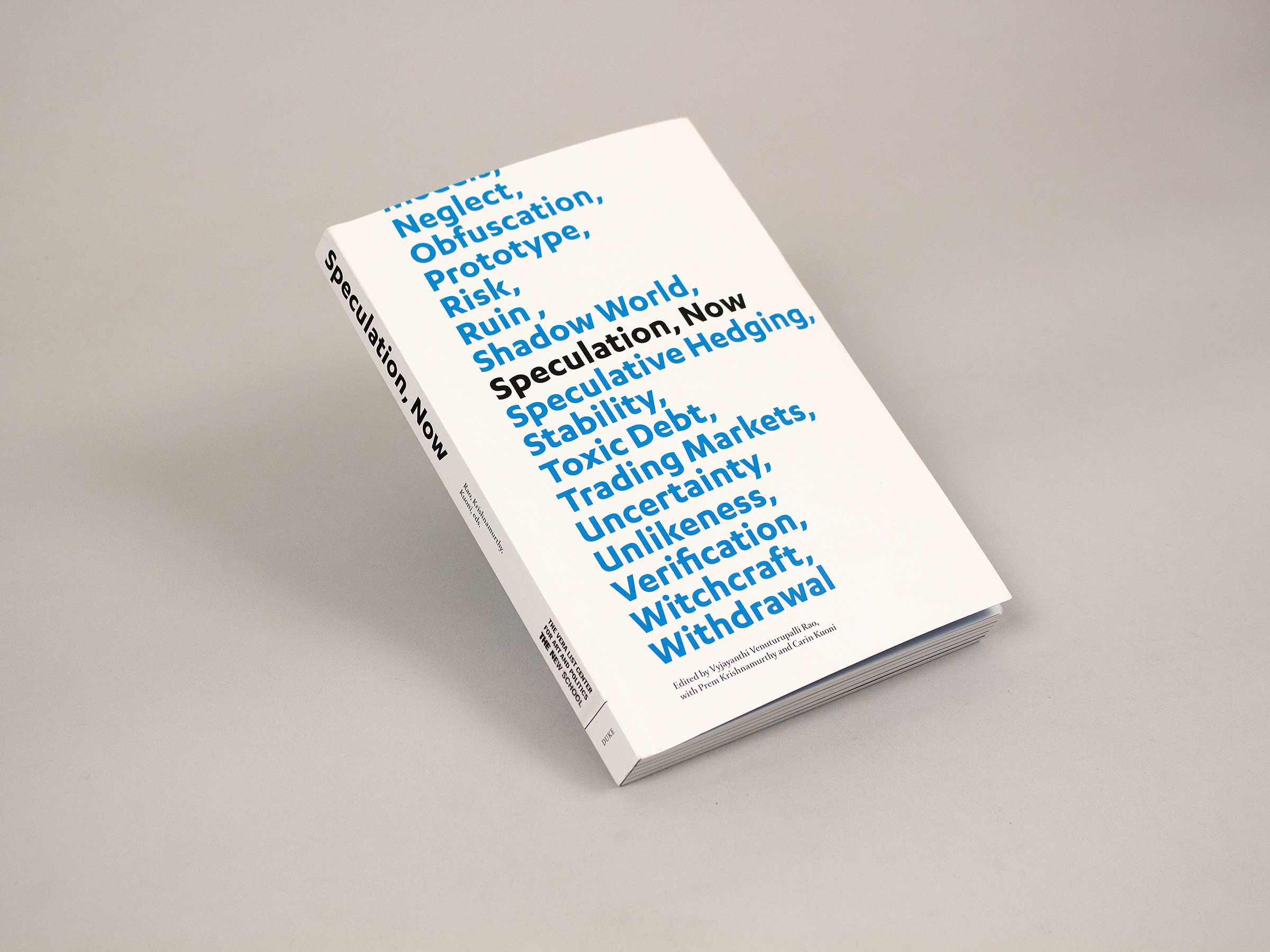

Book

Speculation, Now

What needs to change in our understanding of reality for reality to change? In the face of radical uncertainty, an awareness that things could be otherwise is beginning to organize common frameworks for action and debate. Interdisciplinary in design and concept, Speculation, Now illuminates unexpected convergences between images, concepts, and language. Artwork is interspersed among essays that approach speculation and progressive change from surprising perspectives. A radical cartographer asks whether “the speculative” can be represented on a map. An ethnographer investigates religious possession in Islam to contemplate states between the divine and the seemingly human. A financial technologist queries understandings of speculation in financial markets. A multimedia artist and activist considers the relation between social change and assumptions about the conditions to be changed, and an architect posits purposeful neglect as political strategy. The book includes an extensive glossary with more than twenty short entries in which scholars contemplate such speculation-related notions as insurance, hallucination, prophecy, the paradox of beginnings, and states of half-knowledge. The book’s artful, nonlinear design mirrors and reinforces the notion of contingency that animates it. By embracing speculation substantively, stylistically, seriously, and playfully, Speculation, Now reveals its subversive and critical potential.

Artists + Essayists

Arjun Appadurai, William Darity Jr., Filip De Boeck, Boris Groys, Hans Haacke, Darrick Hamilton, Laura Kurgan, Lin + Lam, Gary Lincoff, Lize Mogel, Christina Moon, Stefania Pandolfo, Satya Pemmaraju, Mary Poovey, Walid Raad, Sherene Schostak, Robert Sember, Srdjan Jovanović Weiss

Advanced Praise for Speculation, Now

“Speculation, Now holds a critical mirror up to the speculative practices that pervade contemporary life only to come away with a generative theory supported by a lexicon. In the book’s course, speculative practices emerge not as edges but as engines of artistic, scholarly, and economic creation, with the lexicon framing core concepts for a speculative renewal: from Credit and Risk to Shadow Worlds and Witchcraft. The voices are many and the disciplinary perspectives kaleidoscopic. But the overall effect is brilliantly choral. Under ever-increasing pressure from degrees of complexity and interconnectivity so great that commonplace ideas of sequence and causality routinely fail, speculation is reborn. It casts aside its prior dreams of mastery in the name of strategies of productive drift and play.”

-Jeffrey Schnapp, Harvard University

“The line between the present and the near future has all but collapsed, and Speculation, Now revels in this space, envisioning a world on the cusp. This wildly diverse book makes the case for a broader definition of applied speculation, not one limited to calculated risk or dreamy conjuring (though it represents both those extremes), but a process that represents an engaged way of understanding the present: through the active desire to change it.”

-Emmet Byrne, Walker Art Center

Glossary Contributors

Benjamin Aranda, Judith Barry, Katherine Carl, Celine Condorelli, Holland Cotter, Özge Ersoy, Reem Fadda, Luke Fowler, Peter Geschiere, Kenan Halabi, Orit Halpern, Graham Harman, Larissa Harris, Victoria Hattam, Jamer Hunt, Angie Keefer & Lucy Skaer, Joachim Koester, Elka Krajewska, Nicolas Langlitz, Marysia Lewandowska, Josiah McElheny, Brian McGrath, Metahaven, Sarah Oppenheimer, Trevor Paglen, Dushko Petrovich, David Reinfurt, Amie Siegel, smudge studios, Beth Stryker, Iddo Tavory, Chen Tamir, Elizabeth Thomas, Hakan Topal, Byron Tucker, Nader Vossoughian, Aleksandra Wagner, McKenzie Wark

Available in bookstores, at online retailers, and directly through Duke University Press.

Glossary contribution

Trading Markets

Byron Tucker

A trading market is a price discovery vehicle involving transference of risk or anticipation of profits in an environment with uncertain outcomes. Modern organized markets show a constant flow of opinions on value that are expressed in price and volume. Graphically they are presented as bar charts reflecting high, low, and last trade with volume shown as a histogram. Such markets are ideal speculative vehicles due to their liquidity, broad price dissemination, and ease of access.

Virtually every trader looks at these visual charts and interprets them personally. They are simple lines on a page onto which we project meaning. Working backwards, the graphs transfer our projections onto the thing itself – the stock or bond or future or currency pair we buy or sell. This imputation of meaning and outcome can of course also be done without any chart, but the directness of projection, unadulterated in its purity, is more clearly expressed when we see lines that lead to actions.

As mechanisms for the creation of meaning, these projections are contingent upon the experience and desires we bring to the process of producing them. Thus, our own, very personal lens determines what we see, and it accounts for the fact that different individuals using the same data draw different conclusions regarding the potential outcome of a trade.

Outcomes, too, elicit individual responses – satisfaction or upset, happiness or anger, et cetera, depending on whether the trade is a profit or a loss. Because we continually interpret the world instead of experiencing it directly, we are always confined by what we bring to it with the emotions being the functional parameters of our encounters with the event of market engagement or of encounters with life.

We experience the market as we experience ourselves, in a process of self-mirroring: what we encounter in the market and in the world is ourselves, as the experience of looking and projecting onto markets is akin to how we see, act on, and react to the world at large. A supreme challenge for a speculator is to break this self-referential cycle and discover profound freedom on the other side.

We ignorantly believe what we see and experience exists independently of us. If we invalidate the false object of our belief, we can come to a true and unobscured vision of our experience. In trading markets this means clear-headed decisions in the context of volatility and risk, free of the contingency of our own self-defeating, self-imposed limitations. Speculation then becomes a statistical process of applying skill and knowledge, and turning an emotional gambit into a probabilistic engagement producing profits greater than losses.

Related

Exhibition